The market has spent most of this year focused on artificial intelligence (AI) fears, software disruption, and volatility across assets like Bitcoin and precious metals.

But there’s another story quietly developing beneath the surface - and it could become one of the most important investment trends of the decade.

Electricity Demand Is Surging

And not just modestly - we’re talking about record levels that are beginning to stress power grids and push prices higher across multiple regions.

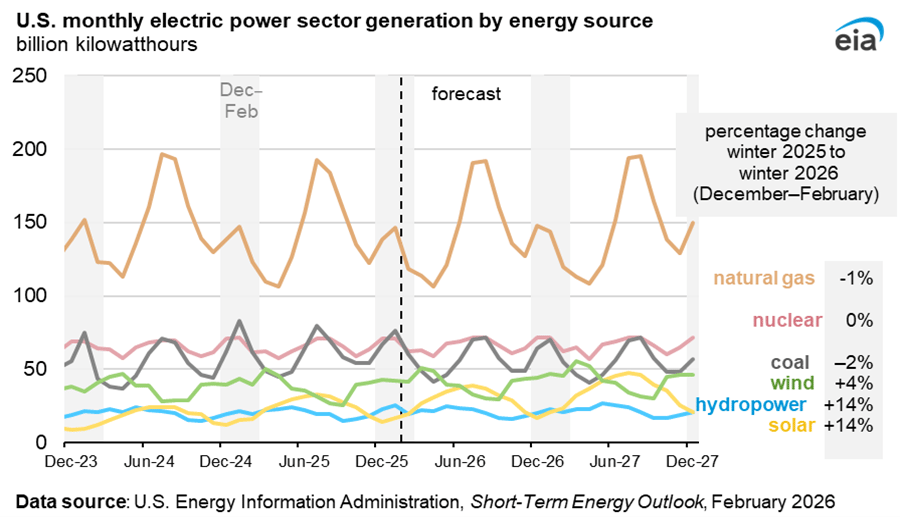

According to the U.S. Energy Information Administration (EIA), electricity consumption is expected to keep breaking records through at least 2027 as demand rises from homes, businesses, and especially energy-hungry data centers tied to AI and digital infrastructure.

This isn’t a short-term spike. It’s a structural shift.

We’re Seeing It Play Out In Real Time

Earlier this winter, the PJM Interconnection - the largest power grid in the United States serving roughly 67 million people - warned that record demand could strain the system and even raise the risk of blackouts.

During peak periods, electricity prices in some areas surged above $1,000 per megawatt hour as congestion and supply constraints forced grids to rely on more expensive generation.

That’s a powerful signal.

And it highlights a reality investors can’t ignore: when demand rises faster than infrastructure can keep up, prices move higher.

We’re also seeing utilities dramatically increase spending to meet this demand wave. Major power companies are pouring tens of billions of dollars into transmission and generation projects as they respond to massive new loads coming from data centers and electrification trends.

The Key Takeaway

Rising demand doesn’t just create opportunity for energy companies. It also creates risk for everyone else.

Electricity is becoming a bigger cost driver across the economy. As power prices rise, companies with high energy usage will see margins pressured, and consumers will feel it through higher utility bills and broader inflation impacts.

In other words, you don’t just want to understand this trend - you want to be positioned on the right side of it.

Because historically, when we see major infrastructure cycles like this, the companies building, generating, and supplying the power tend to be some of the biggest winners.

The International Energy Agency (IEA) has been pounding the table that global electricity demand is expected to grow strongly through the end of the decade, underscoring the need for massive investment in grids and flexibility. That’s another confirmation that this isn’t a temporary phenomenon - it’s a multi-year growth story.

AI runs on data centers. Data centers run on electricity.

And electricity requires generation, transmission, and infrastructure.

Why This Positioning Matters Right Now

Yes, rising power prices could become a headwind for parts of the economy. But they also create a powerful tailwind for the companies positioned to meet that demand.

I continue to believe energy and power infrastructure could be one of the most important areas for investors to watch - and potentially own = in the years ahead.

That’s why this Thursday at 4:00 PM ET, I’m hosting a live event:

During this session, I’ll walk through:

The biggest opportunities emerging from this wild market move

Where capital is rotating right now

How I’m rebuilding and repositioning

And the brand-new energy portfolio I’m putting to work

Because when a trend is this big, you don’t want to be paying the rising costs without also participating in the upside.

If you want to see exactly how I’m positioning for what comes next, join me live this Thursday at 4:00 PM ET.

Here’s to your future,

Matt McCall

Founder, NXT Wave Research