Over the weekend I dug into a new 38-page research paper published by Apollo Global Management. It focused on one theme that’s dominating today’s market: the massive weight of artificial intelligence (AI) stocks inside the S&P 500.

The paper broke down into four sections — market cap concentration, returns concentration, earnings concentration, and capex (capital expenditures) concentration. I pulled one chart from each section to give you the big takeaways… and then I’ll tell you what it all means for us as investors.

Market Cap Concentration

The share of technology, media, and telecom within the S&P 500 is back to levels last seen during the dot-com bubble. On the surface that sounds scary, but here’s the key difference: unlike 2000, our world is now fully dependent on tech. It makes perfect sense that the biggest market-share gains of the last two decades have flowed into the sector driving global innovation.

Returns Concentration

The S&P 500 just hit new all-time highs - but only a handful of stocks are pulling most of the weight. Nvidia, Microsoft, and the rest of the AI giants make up such an outsized chunk of the index that most stocks haven’t even moved. Bears see this as unhealthy. I see it as an opportunity: the other 490 stocks in the index are poised to play catch-up in the years ahead.

Earnings Concentration

The “Magnificent 7” saw earnings growth in the 30% range the last two years. That’s expected to slow to about 19% in 2025 - still solid, but cooling. Meanwhile, the rest of the S&P 500 is turning higher with earnings growth of 8% this year and momentum building into next year. Translation: the bargains are likely hiding in the “493.”

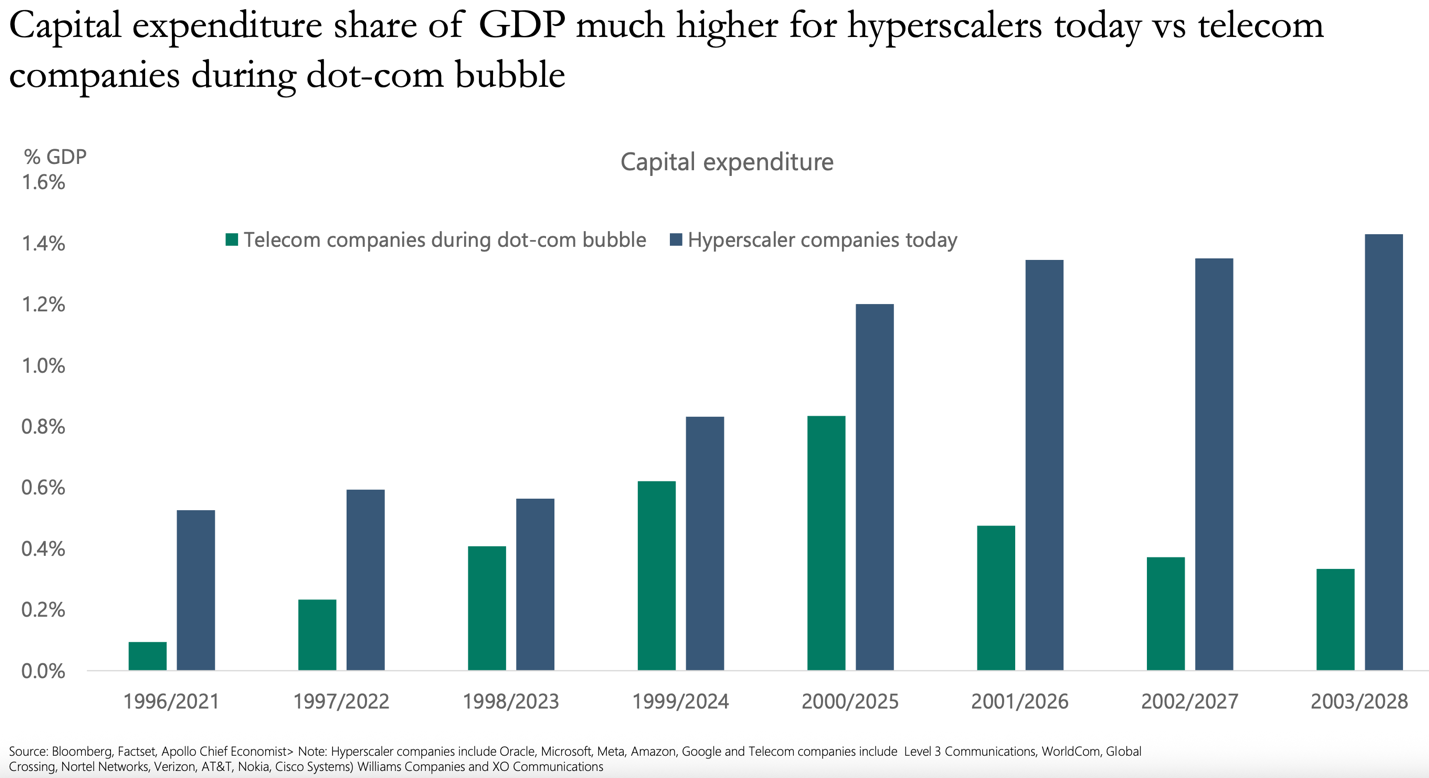

Capex Concentration

Capex is what companies spend on long-term growth - like data centers, servers, and energy infrastructure for hyperscalers. Apollo’s chart shows today’s AI capex as a share of GDP versus the network buildout by telecom companies in the late ’90s. The takeaway: today’s AI investment wave is far bigger and far more necessary than the dot-com buildout. Comparing the two eras doesn’t hold up.

Why Should You Care?

The bears love to scream “bubble!” whenever a sector runs hot. And yes, AI stocks will have pullbacks - just like every big winner over the last 30 years. But betting against AI is betting against one of the most powerful megatrends in modern history. That’s a mistake.

The even better news? The next generation of AI winners won’t be the household names you already know. They’ll be companies hiding in plain sight among the “493.”

One example: ABB Ltd. (ABBNY) - a $128 billion Swiss powerhouse tied to automation, robotics, datacenters, and energy infrastructure. Most financial advisors don’t even know it exists. I recommended it in the AI Revolution portfolio inside NXT Core last year, and it’s already up 40% in just 13 months.

That’s the kind of overlooked play that gives everyday investors a real shot at riding this megatrend for years to come.

For just $79 per quarter (less than 90 cents per day), you’ll get access to every portfolio in NXT Core, plus my weekly video and written updates. Most importantly, you’ll be first in line for the next stock I recommend to all subscribers.

AI is not just another trend; it’s a once-in-a-generation shift that will reshape our world and the markets for decades to come. While the headlines obsess over the “Magnificent 7,” the real wealth will be created in the next wave of innovators that most investors have never even heard of.

That’s one of the key trends I’m focusing on inside NXT Core - uncovering the overlooked companies positioned to deliver life-changing gains as AI transforms the global economy.

Here’s to the future,

Matt McCall

Editor, Market Insights

We’re Going Live in 2 Days!

This Wednesday September 24th at 12 PM ET, I’m hosting a special live webinar you won’t want to miss.

The markets are at a turning point: AI megacaps dominate the headlines, the U.S. just doubled down on nuclear energy, and humanoid robots are moving from science fiction to trillion-dollar reality…

I’ll be sharing one stock idea for free that I believe could ride one of the biggest megatrends of the decade, break down where I see the best opportunities in AI right now, and take your questions live.

Keep an eye out for a follow-up link later this week to reserve your spot!