It’s been a long, cold stretch for biotech investors. But that’s changing fast. After spending a few years in the market’s penalty box (for my Flyers fans), the biotech sector is finally waking up - and this time, the rally looks real.

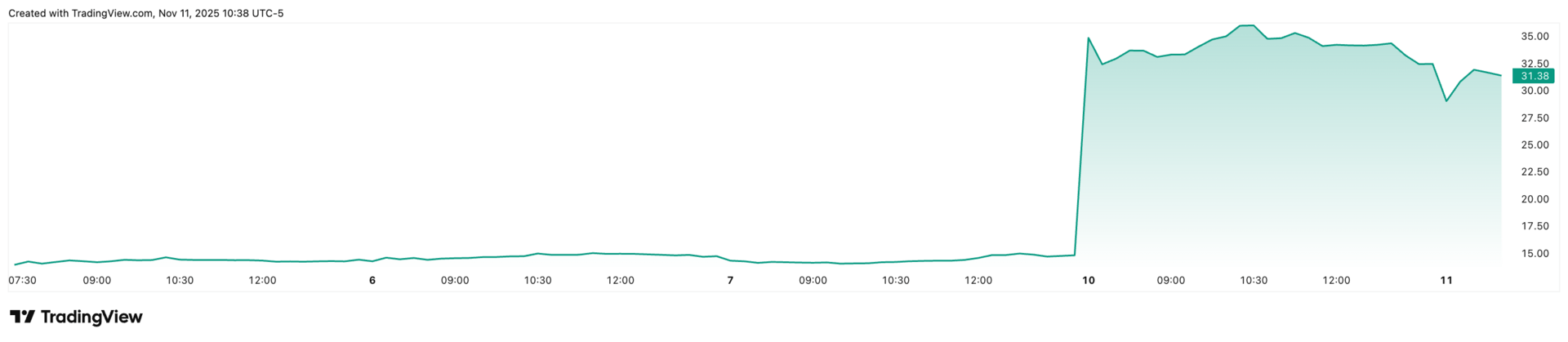

The SPDR S&P Biotech ETF (XBI) - the most widely followed biotech benchmark - is up roughly 25% this year through October, outperforming the S&P 500 by nearly 10 points. That’s not noise… that’s the market starting to price in a new wave of innovation and opportunity.

SPDR S&P Biotech ETF (XBI)

So what’s behind the comeback? Let’s break it down.

1. Breakthroughs Are Being Rewarded Again

For the last few years, even when biotech companies announced positive clinical-trial results, their stocks often fell. Investors didn’t want to touch risk. But that mood has flipped.

Now, when a company releases good data, Wall Street is rewarding it with big moves higher. Confidence is returning - and that’s critical for a sector driven by scientific progress.

In short: the market is once again paying for results. That’s the spark biotech needed.

Example: Cogent Biosciences (COGT) up 120% yesterday.

Cogent Biosciences, Inc.

2. Big Pharma Needs Fresh Pipelines

Many of the world’s largest drugmakers are staring down what’s known as the patent cliff - meaning some of their biggest moneymakers are losing exclusivity soon.

When that happens, they need to go shopping. That’s great news for smaller biotech firms with promising drugs, because it often leads to buyouts or partnerships at premium prices.

We’re already seeing more mergers and acquisitions - a clear sign big pharma is opening its checkbook again.

Example: Metsera (MTSR) – After a prolonged bidding war with Novo Nordisk, Pfizer will acquire Metsera in a deal that could be worth more than $10 billion.

Metsera, Inc.

3. Falling Rates Help Growth Sectors Like Biotech

Biotech companies spend years - sometimes a decade or more - developing treatments before turning a profit. So when interest rates fall, it lowers their cost of capital and boosts the future value of those potential profits.

With the Fed already in rate-cut mode, that tailwind just kicked in.

4. The Weak Got Washed Out

The biotech bear market over the last couple of years forced hundreds of speculative players out of business. What’s left is a stronger, leaner group of companies with real science, solid balance sheets, and credible management teams.

Think of it as a natural selection process - the survivors are now positioned to thrive.

5. It’s Still Early

Even after the recent rebound, the sector remains well below its 2021 highs. That means there’s still plenty of upside for investors who get in early. And with trends like gene editing, precision medicine, and AI-driven drug discovery accelerating, the long-term potential is enormous.

Bottom Line: Biotech is back - and I believe we’re in the early innings of what could be a multi-year bull run. Innovation is accelerating, money is flowing back in, and investors are finally paying attention again.

Coming soon, I’ll share a few of my favorite biotech stocks to watch - including one company sitting on data that could transform an entire field of medicine.

Stay tuned…

Heres to your future,

Matt McCall

Founder, NXT Wave Research