Bear Market… or Typical Pullback?

That’s the question I’ve been wrestling with over the past 48 hours.

Unfortunately, the answer isn’t simple.

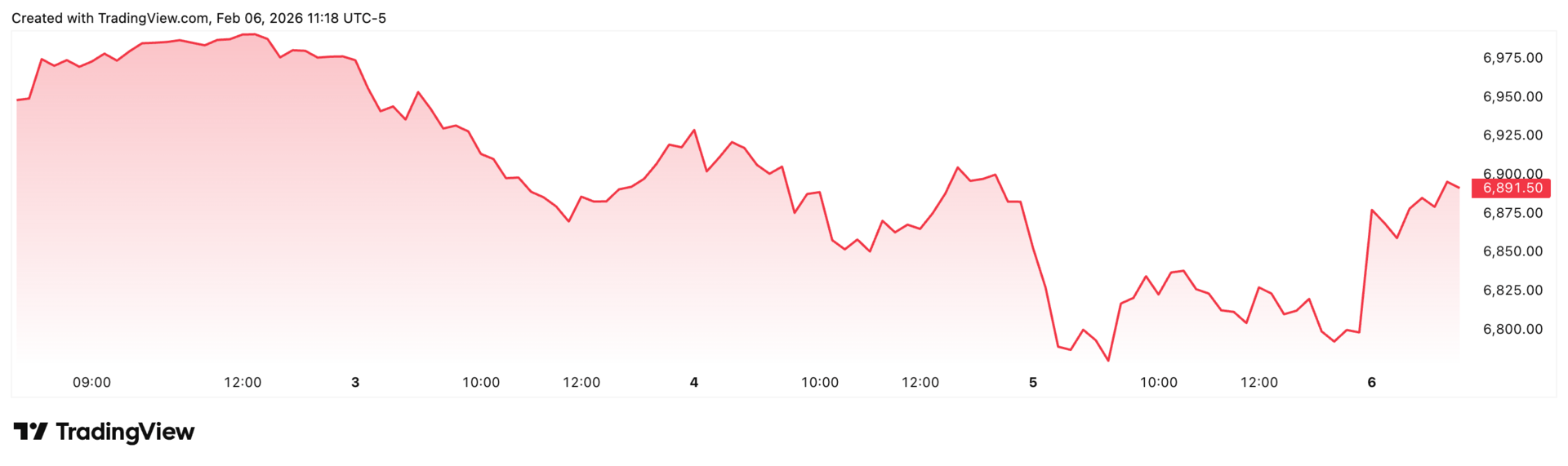

Before I explain why, let’s take a clear look at what’s actually happened in the market this week:

Through the first four days of the week, the S&P 500 is down 2% and trading 2.6% below its all-time closing high. This morning, the index is rebounding and up about 1.3% in early trading.

S&P 500 Index

Over the same timeframe, the S&P 500 Equal Weight ETF (RSP) was up 0.25% coming into today and sat just 0.9% below the all-time high it set on Wednesday. This morning, RSP is hitting a new all-time high.

Invesco S&P 500 Equal Weight ETF

Gold and silver have experienced one of the most volatile two-week stretches in their history. Silver alone lost roughly one-fourth of its value in just 24 hours.

Gold Spot / U.S. Dollar

Bitcoin fell more than 50% from its 2024 high before appearing to find at least a short-term bottom late last night.

Bitcoin

A Cross-Sector Snapshot of the Market

Money is flooding into consumer staples as a hedge against volatility. The sector’s four-week average inflow is the highest since data began in 2008—17 times higher than its 12-week average. The Consumer Staples ETF is hitting a new all-time high today.

Other sector ETFs hitting new highs today include Energy, Industrials, and Regional Banks—a remarkably diverse mix.

On the flip side, software has been crushed. The Software ETF is down 32% from its September 2024 high and nearly 12% just this week. The fear is that AI will disrupt the sector. Some of that thesis is valid—but it’s also creating real long-term winners trading at steep discounts.

Even with this week’s pullback, small caps remain strong. The

Russell 2000 ETF is up 6.7% year-to-date, compared with just a 0.7% gain for the S&P 500.

iShares Russell 2000 ETF

Meanwhile, the Magnificent Seven ETF—made up of the mega-caps everyone still talks about—is down 4.5% so far in 2026.

So Where Does That Leave Us?

In the short term, this market is unlike anything I’ve seen in my 25+ years of investing—and that’s not a bad thing. Markets never repeat exactly, and when they feel unfamiliar, opportunity usually follows.

My takeaway is this: There are clear pockets of strength breaking out in what looks like a full-blown bull market—while other areas have quietly been in bear markets for months.

If you invest in high-growth trends, you likely have a little of both in your portfolio right now.

As for my plan? I’m not changing anything today.

There’s no reason to sell a stock just because it’s down for a few days. As long as the original thesis remains intact, the stock remains a buy or hold.

That said, this environment is creating opportunity:

First, there are swing-trading setups where the sell-off went too far, too fast—and I plan to take advantage of them.

Second, if you’ve been waiting months to buy a stock and it’s finally pulled back 20% to your target entry—buy it. You’ll never catch the exact bottom. Build positions gradually, as long as your original thesis hasn’t changed.

As uncomfortable as markets like this can feel, remember:

This is when the best investors do their best work.

Here’s to your future,

Matt McCall

Founder, NXT Wave Research

This week, I sat down with veteran investor Lou Basenese to break down what’s really happening beneath the surface of this market — and the takeaway is clear:

Earnings are holding up. Productivity is improving. Leadership is broadening — and small caps are stepping forward.

That combination has historically aligned far more with opportunity than risk.

If you want the full breakdown, the data behind these trends, and the specific names we discussed, watch the latest episode of Market Insights.