For the first time in weeks, we finally got a piece of official economic data - and it didn’t disappoint.

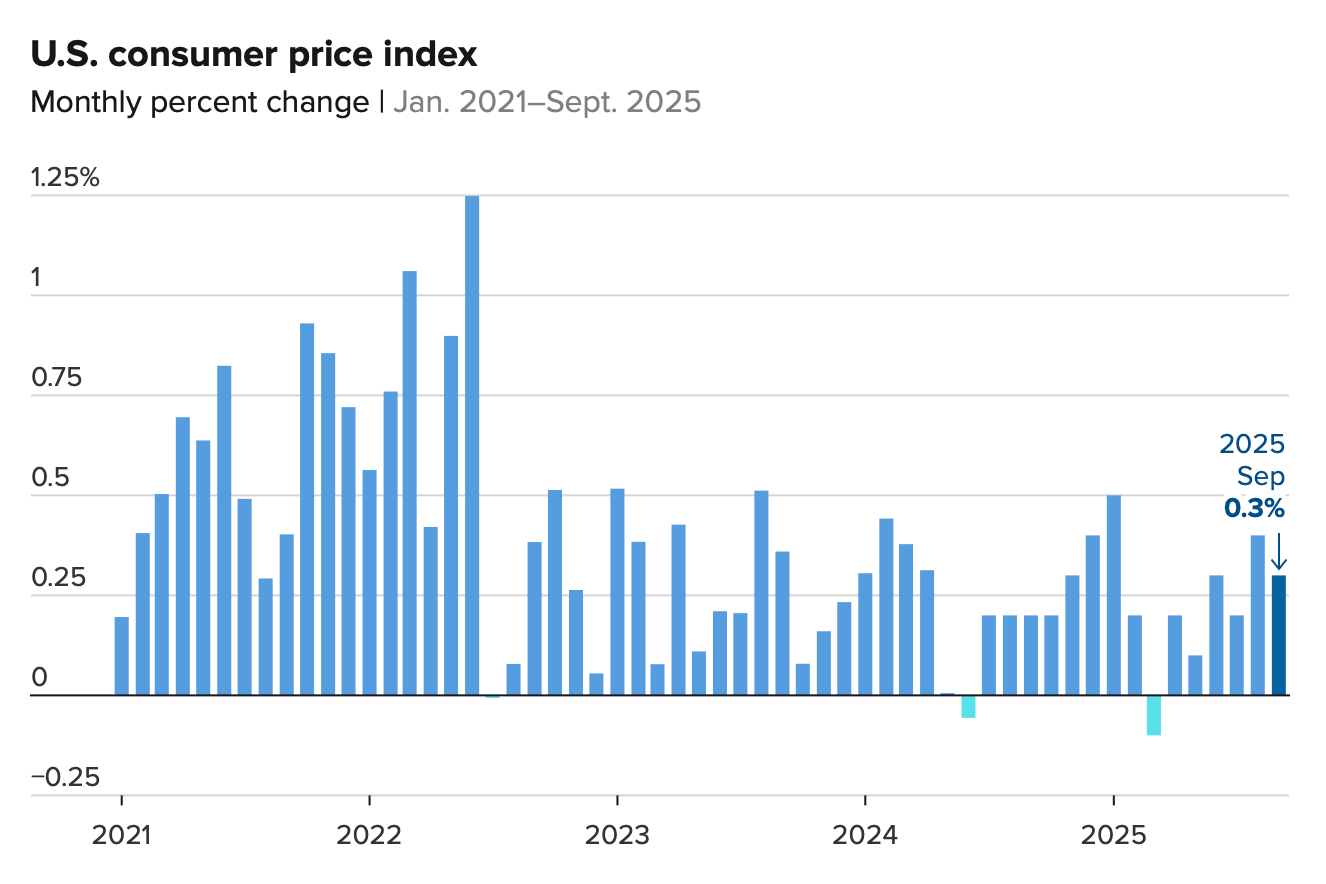

This morning’s Consumer Price Index (CPI) report showed prices rose just 0.3% in September, softer than the 0.4% economists expected. On an annual basis, inflation sits at 3.0%, slightly below forecasts and well within the “comfort zone” the Federal Reserve wants to see as it gears up for another rate cut next week.

Strip out food and energy - the so-called “core” CPI - and prices climbed only 0.2% for the month, matching the slowest pace of 2025. That marks the second straight month of improvement and signals the inflation dragon may finally be tamed.

And the stock market loves it.

The S&P 500 surged to a new all-time high within hours of the release, while Treasury yields dipped modestly. Traders are now pricing in a 99% chance of a Fed rate cut at next week’s meeting and nearly the same odds of another in December.

The Fed’s Green Light

This was the last major data point the Fed will see before its policy meeting - and it’s exactly the one the stock market bulls wanted. Inflation is cooling, the labor market is showing signs of softening, and growth remains steady.

Translation: the Fed can ease without fear of reigniting inflation.

Remember, the central bank’s official goal is 2% inflation. We’re not there yet, but 3% is close enough (in my opinion) - especially given the lagged effects of earlier tightening.

For months, I’ve been saying the Fed is done fighting inflation and will pivot toward defending employment. Today’s CPI print seals that case.

What’s Behind the Numbers

Energy prices were a mixed bag - gasoline jumped 4.1% from last month, but over the past year, it’s actually down 0.5%. Food prices rose a modest 0.2% in the month. Shelter, the single biggest component of CPI, climbed only 0.2%, its lowest increase in over a year.

That moderation is critical. Housing and rent costs have been the sticky part of inflation, and this pullback means the worst may be behind us.

Meanwhile, core goods rose just 0.2%, suggesting that tariffs and supply shifts haven’t reignited inflation - at least not yet. Many U.S. companies are already sourcing materials from non-tariff nations, helping blunt cost increases.

Trade War Profits Are Back

Breaking news: China just walked away from key U.S. trade talks —

and markets are reacting fast.

Most investors see chaos… I see opportunity.

Because history shows every tariff cycle creates massive winners —

the companies positioned on the right side of the trade war.

In my latest video, I reveal the top “Tariff War” stocks set to surge as America

doubles down on manufacturing, energy, and supply-chain independence.

What It Means for Investors

Rate cuts are bullish for nearly every sector. Lower borrowing costs support everything from housing to tech valuations to corporate profits.

With inflation cooling and the Fed back in easing mode, this is a “Goldilocks” moment for stocks - not too hot, not too cold. And that’s why the market is setting new records even amid political drama and trade tensions.

If history is any guide, the first cut of a new easing cycle tends to trigger a multi-month rally. The biggest gains often go to growth sectors - especially tech, AI, and industrial innovation - the same megatrends we’ve been targeting all year in my portfolios.

So don’t fight the Fed… or the tape.

This bull market has more room to run.

Here’s to the future,

Matt McCall

Editor, Market Insights

P.S. Inflation is cooling, rate cuts are coming, and the next leg of the bull market is about to begin. In NXT Core, I’m positioning for exactly this environment - where smart investors can turn macro trends into real profits.