Dear subscriber,

2026 is right around the corner.

Wall Street strategists are already publishing their forecasts.

Some are calling for the S&P 500 to push through 8,000 next year — more than 15% upside from here.

I don’t invest based on Wall Street forecasts.

I invest based on megatrends, money flow, and where the world is actually going.

And here’s what I know for sure:

• The AI infrastructure boom is accelerating

• Electrification, automation, and healthcare innovation are exploding

• The biggest wealth in 2026 will be made in the stocks most people still don’t fully understand

That’s why my flagship research service — The McCall Letter — exists.

Every week, I cut through the noise and show subscribers:

• Where the big money is moving

• Which megatrends are gaining momentum

• And the specific stocks positioned to benefit the most

Today, I want to give you a sneak peek.

Here are 10 stocks I believe will define 2026 — and three you need to know right now.

My Top 10 Stocks for 2026 (Preview List)

These companies sit at the center of the biggest forces shaping the global economy:

• AI & automation

• Energy and electrification

• Healthcare innovation

• Infrastructure build-out

In The McCall Letter, I break down all 10 in full detail — but here are three of the most powerful names on the list.

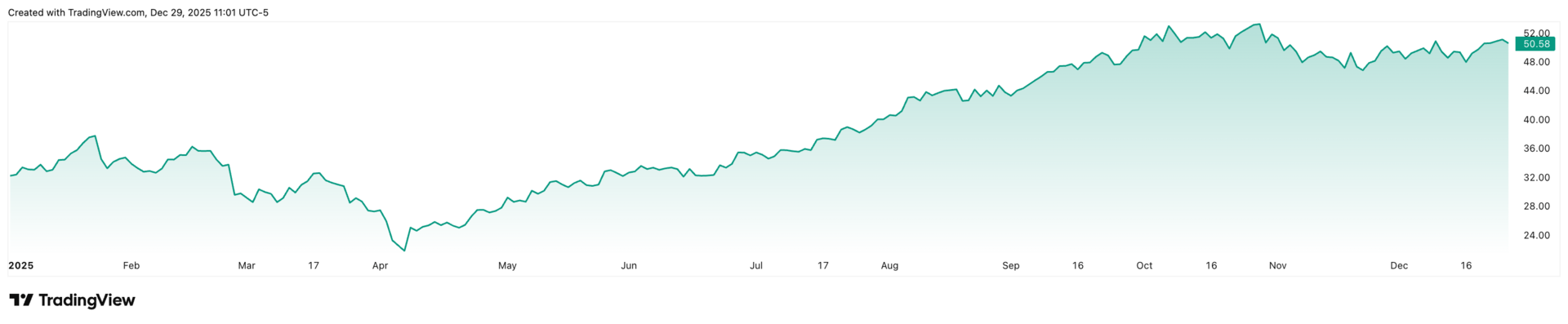

10. Prysmian Group (PRYMY)

Connecting the AI & Power Revolution

Prysmian Group (PRYMY)

Company Profile

Prysmian is the world’s largest manufacturer of power cables and fiber-optic lines.

They make the physical connections that allow electricity and data to move across the globe.

Every AI data center, EV charging network, offshore wind farm, and power-grid upgrade needs Prysmian’s products.

Global network of cables will have to more than double by 2050 – roughly the distance between the Earth and the Sun.

Why It’s On My 2026 List

• AI data centers are exploding, and they require massive amounts of power and fiber

• Governments are spending hundreds of billions to modernize electric grids

• Prysmian is one of the few companies on Earth that can supply this infrastructure at scale

This is a picks-and-shovels play on AI and electrification.

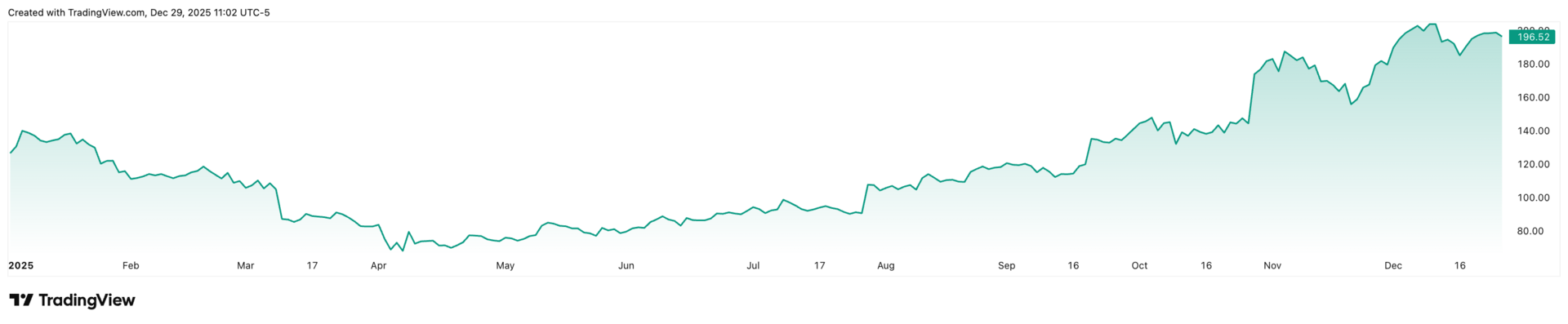

9. Teradyne (TER)

The Gatekeeper of the Semiconductor Boom

Teradyne (TER)

Company Profile

Teradyne builds the testing equipment used to verify that advanced computer chips actually work.

If Nvidia (NVDA), AMD (AMD), TSMC (TSM), or any AI chipmaker wants to ship chips — they go through Teradyne.

They also own Universal Robots, a leader in collaborative robotics.

Why It’s On My 2026 List

• AI chips are becoming more complex and more expensive

• That means testing becomes more critical — and more profitable

• Teradyne sits at the choke point of the global semiconductor supply chain

This is a quiet AI winner most investors overlook.

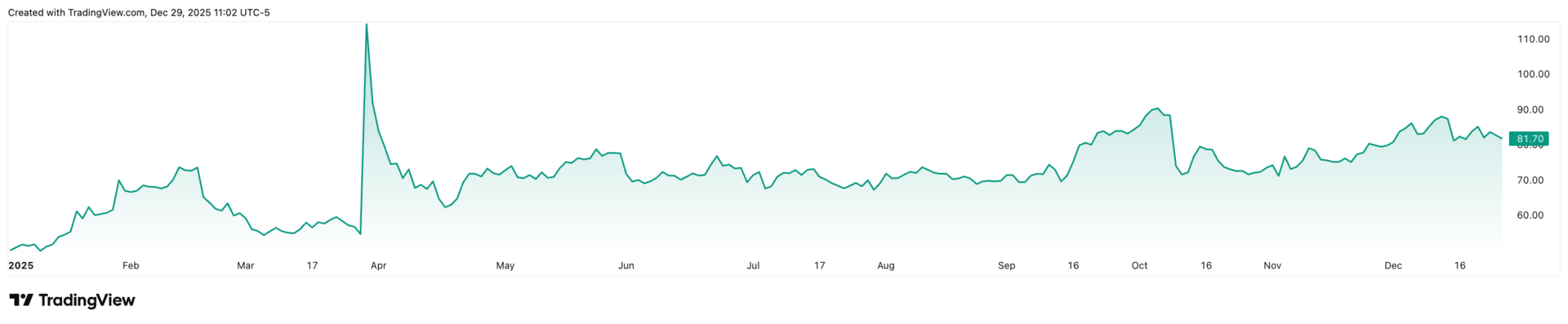

8. Corcept Therapeutics (CORT)

A Breakthrough Healthcare Story Most Wall Street Still Misses

Corcept Therapeutics (CORT)

Company Profile

Corcept develops drugs that regulate cortisol — a hormone tied to metabolic disease, depression, cancer, and inflammation.

They already have a profitable drug on the market and a deep pipeline behind it.

Why It’s On My 2026 List

• Cortisol is emerging as one of the most important targets in modern medicine

• Corcept has years of real-world data and multiple late-stage drugs

• This is a biotech that actually makes money — with major upside ahead

This is the kind of under-the-radar healthcare winner that can double or triple when Wall Street finally catches on.

These Are Just 3 of the 10

Inside The McCall Letter, subscribers get the full Top 10 for 2026, including:

• AI & robotics leaders

• Infrastructure plays Wall Street is still missing

• Healthcare disruptors

• Energy & electrification winners

Along with:

• Buy & sell alerts

• Weekly market analysis

• Megatrend breakdowns

• Live quarterly webinars

This is the same research that’s helped me call: Tesla. Nvidia. Bitcoin. AMD. Nuclear energy. Rare earths. AI.

Before the crowd.

Your Next Step

If you want to be positioned ahead of 2026 — not chasing it, you need to be in The McCall Letter.

That’s where I show you:

• What I’m buying

• What I’m avoiding

• And where the next wave of wealth will come from

Let’s make 2026 your best investing year yet.

Talk soon,

Matt McCall

Founder, NXT Wave Research

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.