This morning copper prices exploded to an all-time high above $14,000 per metric ton (above $6.50 per pound), extending a dramatic rally across industrial and precious metals.

But the mainstream take frames this movement as driven by speculators, and implicitly detached from real economic demand.

“Speculators Pile In”

In its coverage of copper’s record surge, Reuters highlighted speculative buying as a central driver - investors piling into futures and hard assets on expectations of future demand, buoyed by geopolitical risk and a weak U.S. dollar.

It quoted market participants calling the rally “intense speculative trading,” and noted that physical demand fundamentals in key markets like China remain soft.

This narrative - “it’s speculators, not fundamentals” - has long been the default for metals that aren’t gold or silver. The implication is clear: when traders push metals higher without concurrent physical consumption spikes, the movement is a bubble or a blip, not a structural shift.

But as we’re seeing in real-time, that interpretation is too simplistic.

Gold & Silver Are Breaking Out - And It’s Not Labeled “Speculation”

At the same time copper is at record highs, gold and silver prices are exploding on the back of safe-haven demand and dollar weakness.

Recent Reuters coverage - just days before the copper story - noted gold racing past historical highs as investors rushed into the metal amidst geopolitical unease and a sliding dollar.

Silver has joined that march, with precious metals benchmarks hitting historic peaks simultaneously with copper.

Here’s the key contrast:

Copper and base metals: framed as speculative price action detached from demand.

Gold and silver: contextualized as safe-haven assets driven by real macro risks - inflation expectations, geopolitical tension, and currency breakdown fears.

The labeling - speculation vs safe haven - matters. It shapes investor psychology, regulatory scrutiny, and how institutions allocate capital.

If You’re Buying Gold Out of Fear… You May Already Be Late.

The real market battle isn’t elections or rates — it’s resources.

It’s already reshaping the global economy and financial markets.

In this week’s podcast, I break down what most investors are missing — and why one of the market’s most crowded trades may be nearing bubble territory.

So What’s Really Driving These Breakouts?

Rather than pure “speculation,” the broader metals rally shares common structural drivers – a weak U.S. dollar.

U.S. Dollar Weakness

A weaker greenback makes commodities priced in dollars more affordable for global buyers and is boosting inflows across the complex - from copper to gold.

Heightened geopolitical tensions have pushed investors toward real assets that preserve purchasing power and hedge uncertainty - a force long acknowledged for gold, increasingly visible across the whole metals spectrum.

Rotation in investment flows

As gold and silver rallied into fresh highs, money has increasingly rotated into other hard assets, including base metals, as investors seek diversified inflation and risk hedges.

Fundamentals vs Financial Dynamics

Yes, some components of the rally reflect financial positioning - futures and ETF flows - but that’s true in most markets. That doesn’t make the move irrational. It reflects real macro stressors:

Lower real interest rates and expectations of future cuts

Persistent inflation concerns

Dollar depreciation

Strategic raw material demand tied to energy transition and infrastructure

Importantly, the same forces cited for gold and silver price strength - weak dollar, geopolitical uncertainty, safe-haven demand - are in play for copper and other industrial metals.

The Bigger Picture for Investors

Rather than dismissing the copper rally as mere “speculation,” this breakout should be assessed in the context of a broader real-assets repricing:

Precious metals are signaling risk hedging and monetary stress.

Industrial metals are responding to dollar weakness and structural demand expectations.

Commodities overall are trading less like isolated goods and more like macro barometers.

When gold and silver’s surge is labeled macro signal, but copper’s is labeled speculative excess, it reveals more about narrative bias than market reality.

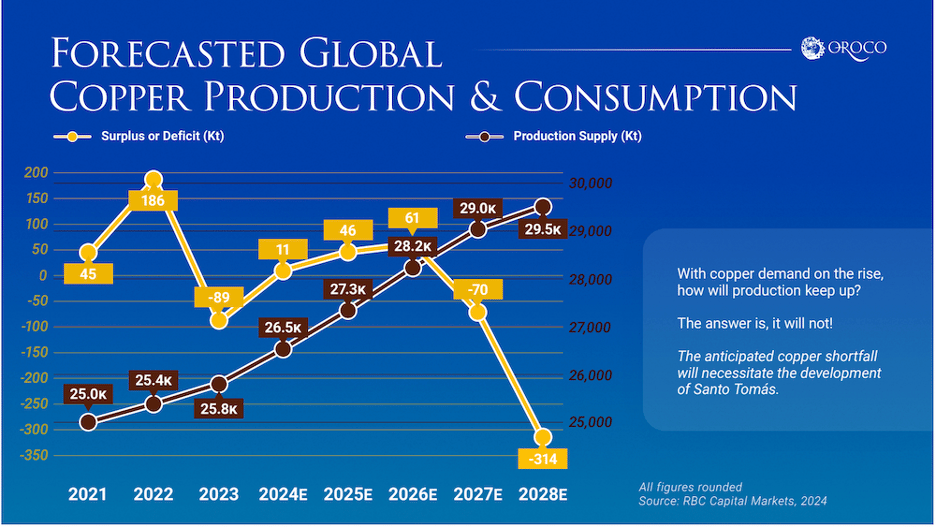

I will leave you with this chart to chew on…

Here’s to your future,

Matt McCall

Founder, NXT Wave Research