Stocks have been pulling back from all-time highs, and the mainstream media has been pushing an extremely bearish sentiment. At the same time, the S&P 500 finished last week down 2.8% from its late October high.

So why do investors feel like this very normal - and even healthy - pullback from a high is the start of something much worse?

Let’s look at some charts.

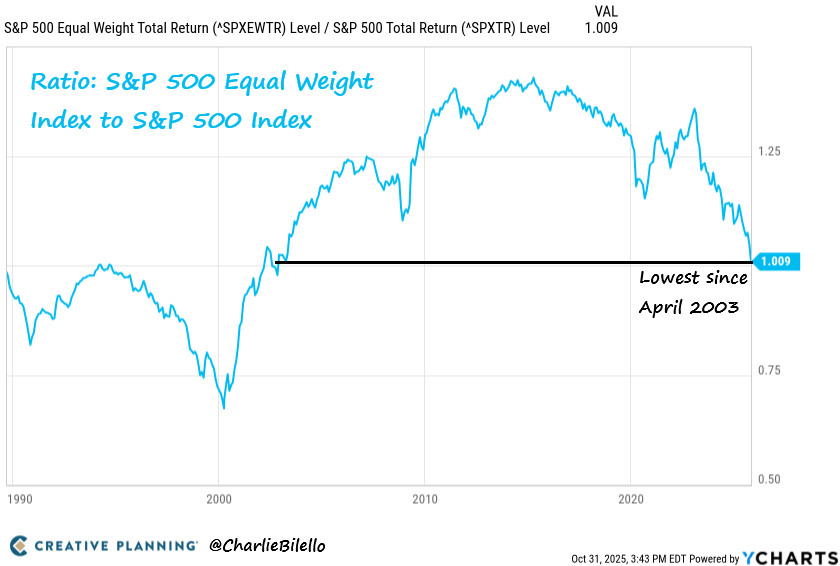

Here’s a chart from Charlie Bilello that shows the equal-weight S&P 500 versus the traditional S&P 500 that most of us follow.

Source: Bilello.Blog

The latter is market-weighted, meaning the larger the company, the more influence it has over the index’s value. The equal-weight index, on the other hand, is rebalanced quarterly - so each stock returns to represent 0.2% (1/500th) of the total index.

The S&P 500 equal-weight ratio to the traditional S&P 500 is now at its lowest level since 2003. This is one reason many investors don’t feel as bullish as the major indices suggest.

Unless you’re invested heavily in the largest stocks in the market (think the “Magnificent 7”), there’s a good chance your portfolio is lagging the overall return of the S&P 500.

At the end of October - as all three major indices were hitting new record highs - 42% of the stocks in the S&P 500 were down on the year. And more than half of the stocks in the Russell 2000 (small- and mid-cap stocks) were negative through the first ten months of the year.

So, if your portfolio is underperforming the market, it’s likely because you have less exposure to the biggest stocks.

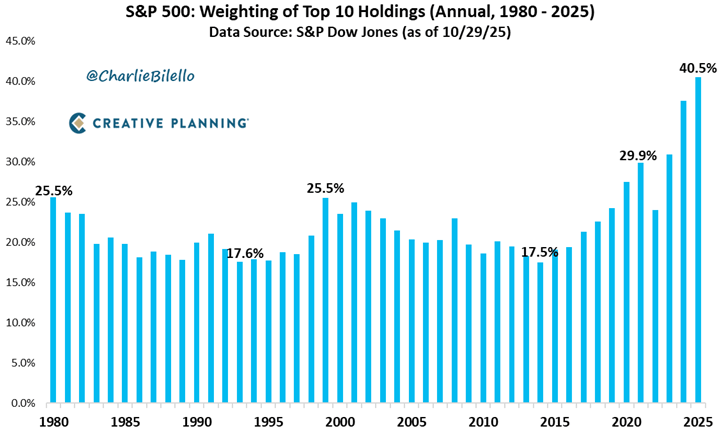

The chart below shows that the top 10 holdings in the S&P 500 now make up a larger percentage (40.5%) of the index than at any point in the last 45 years.

Source: Bilello.Blog

In my opinion, this trend will not continue. Sure, I still believe the largest stocks will perform well as the AI megatrend continues. But I also believe the other 490 stocks in the S&P 500 - and even smaller companies in the Russell 2000 - have the potential to become the next generation of leaders.

As I’ve mentioned several times over the past year, my largest position in my IRA rollover account is RSP - the equal-weight S&P 500 ETF. I believe this will outperform the traditional S&P 500 over the next five years.

So when you look at your portfolio returns through the first ten months of the year and wonder why you’re lagging, there are two likely reasons:

First, as mentioned, you have less exposure to the “Big 10.”

Second, you’re probably not yet a member of The McCall Letter—where you can gain instant access to all my portfolios covering everything from AI to Deep Sea Mining.

We’ve been crushing the market, even with little to no exposure to the largest stocks.

If you’d like to see exactly what we’re buying, you can get access to The McCall Letter here.

Heres to your future,

Matt McCall

Founder, NXT Wave Research