Hi, Matt McCall here.

For years, quantum computing lived in the category of “interesting, but far off.”

That’s no longer the case.

What we’re seeing now is a turning point, where government funding, real technological breakthroughs, and early commercial revenue are starting to converge.

This is typically the moment when a new technology moves from theory into real-world impact — and when long-term investment opportunities begin to form.

Let’s Start With Funding

The National Quantum Initiative Reauthorization Act (NQIRA) is currently making its way through Washington. While the final details are still being debated, the proposal includes up to $2.7 billion in funding for quantum research, infrastructure, and commercialization.

The key takeaway isn’t the politics — it’s the priority. Quantum computing is now viewed as strategic national infrastructure, alongside AI, semiconductors, and advanced manufacturing.

Governments don’t commit billions of dollars unless the payoff is expected to be massive.

At the same time, the private sector is making real progress. Google recently announced that its “Quantum Echoes” algorithm, running on its Willow 105-qubit quantum chip, can perform certain calculations 13,000 times faster than the world’s most powerful classical supercomputers. That’s not an incremental improvement — that’s a step-change.

Why Does This Matter?

Quantum computers aren’t just faster versions of today’s machines. They’re designed to solve problems that classical computers can’t solve at all — including complex molecular modeling, materials science, optimization, cryptography, logistics, and advanced AI workloads.

And importantly, quantum computing doesn’t replace traditional computing. It works alongside it, acting as a force multiplier for the hardest problems. That’s why quantum is best thought of as the next layer of the AI revolution, not a competing technology.

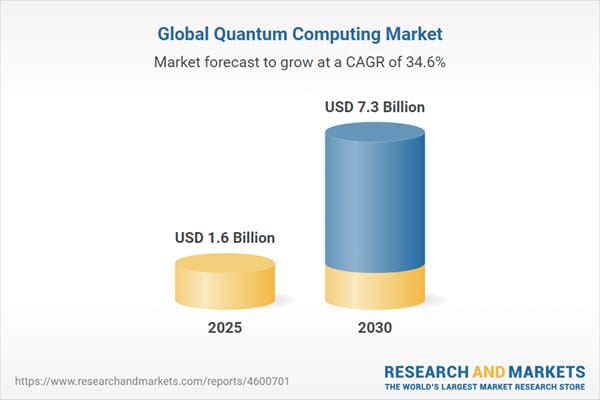

This shift is already showing up in early revenues. Industry-wide quantum computing revenue is estimated to have grown from roughly $225 million in 2023, to $700 million in 2024, and could surpass $1 billion in 2025.

Those numbers may look small — but early revenue growth is often the first signal that a technology is moving out of the lab and into the real economy.

The global market for quantum computing technologies is expected to grow from $1.6 billion in 2025 to reach $7.3 billion by the end of 2030.

The Founders Allocation Is Almost Full…

Last week, I opened a one-time Founders Allocation to a small group of subscribers.

With only a few spots remaining, this is your opportunity to secure a position to The Select Portfolio 2026 before it closes December 24th.

The Select Portfolio is not about trading headlines or chasing the hottest stock of the week.

It’s about positioning capital ahead of the biggest shifts I see unfolding over the next year — across biotech, AI’s second act, automation, electrification, copper, defense, infrastructure, mining, and more.

👉 Secure Your Select Portfolio 2026 Founders Allocation Spot Here

Where Are Investors Able To Get Exposure?

The quantum opportunity spans several different types of companies:

Some are pure-play quantum hardware developers, building the machines themselves. Others are infrastructure and tool providers, supplying the ultra-precise equipment needed to design, test, and manufacture quantum chips. And then there are established technology and industrial firms investing heavily in quantum as part of their long-term AI and cloud strategies.

Companies like

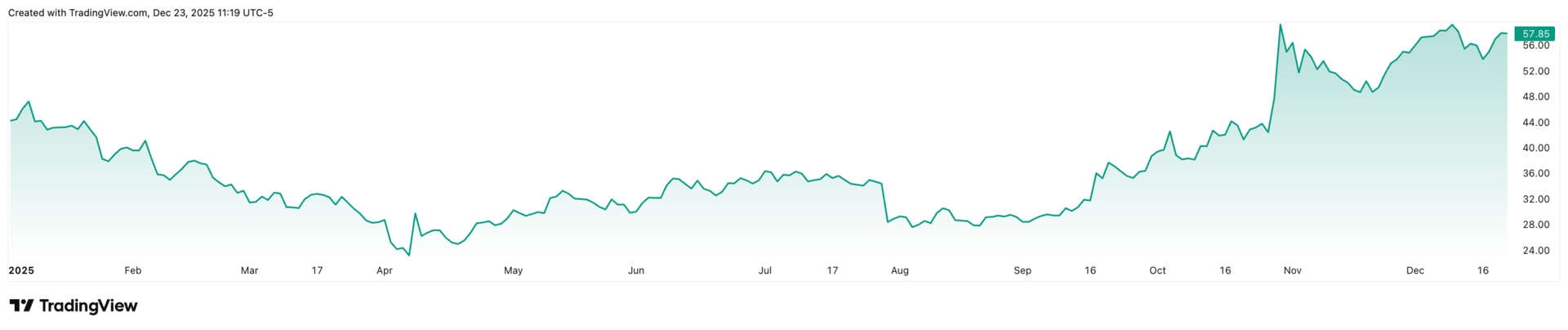

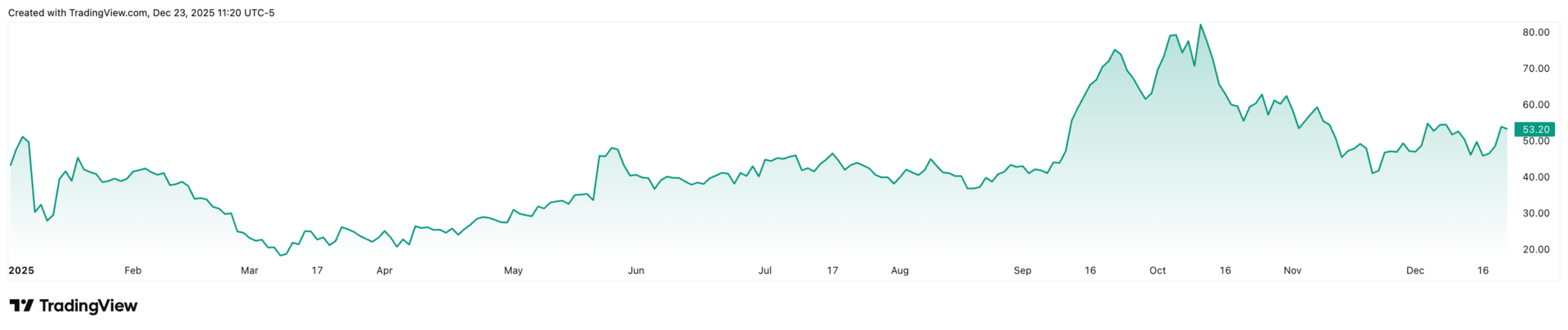

Honeywell (HON)

Honeywell (HON), through its advanced quantum subsidiary Quantinuum, provide lower-risk exposure inside a profitable industrial business.

FormFactor (FORM)

FormFactor (FORM) benefits behind the scenes by selling critical testing equipment required to build quantum chips.

IonQ (IONQ)

IonQ (IONQ) and D-Wave Quantum (QBTS) represent more direct quantum hardware plays, each focused on different approaches to solving real-world problems.

IBM (IBM)

IBM (IBM) brings enterprise-scale resources, cloud access, and decades of research leadership.

And firms like XtalPi (QNTPF) show how quantum-inspired computing is already being applied in areas like drug discovery today.

This range of approaches is important. Quantum investing isn’t about betting everything on one breakthrough. It’s about measured exposure to a technology that is crossing from experimentation into commercialization.

That’s exactly how I’ve approached quantum inside my broader 2026 framework — and one of these companies is included in the 2026 Select Portfolio as a way to gain early exposure while the market is still underestimating what’s coming.

Timing Matters

The 2026 Select Portfolio price will increase by $1,000 — from $995 to $1,995 — tomorrow, once the Founders window closes. That reflects the portfolio moving from early positioning into active management.

Quantum computing is still early.

But the window to get positioned early is narrowing.

I’ll continue breaking down these themes in Market Insights. For investors who want direct exposure to the companies at the center of this turning point, the 2026 Select Portfolio is where I’m putting these ideas to work.

Talk soon,

Matt McCall

Founder, NXT Wave Research