Hi, Matt McCall here.

One of the most powerful investment trends heading into 2026 is the rise of robotics and automation — and the scale of what’s coming is far larger than most investors appreciate.

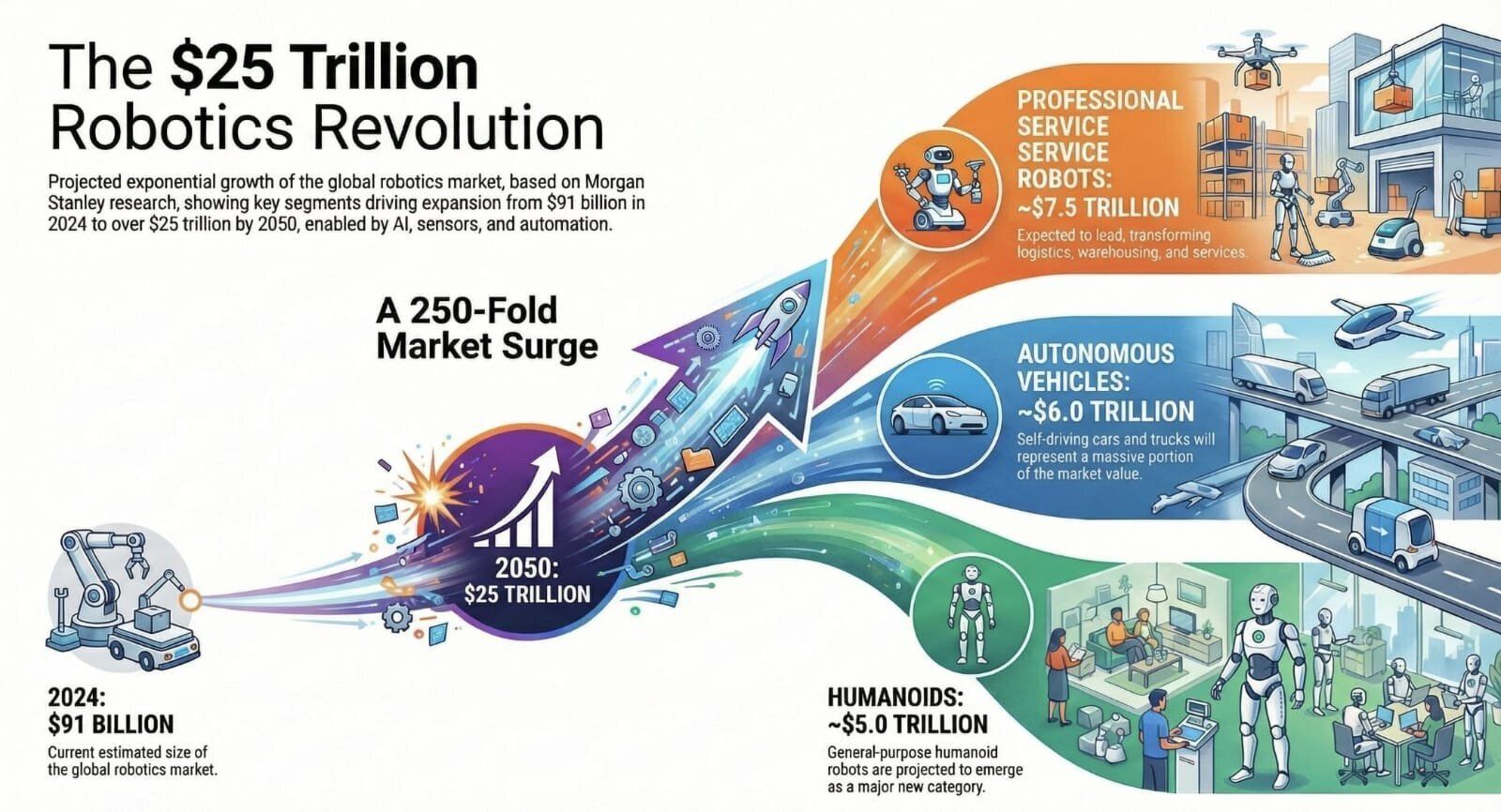

According to industry projections, the global robotics market is expected to grow from roughly $90 billion today to as much as $25 trillion by 2050.

That’s not incremental growth — that’s a 250-fold expansion, driven by artificial intelligence, sensors, software, and automation spreading into every corner of the economy.

We’re Still In The Early Innings

Despite years of headlines, U.S. manufacturing remains significantly under-automated. Today, the U.S. has only about 141 robots per 10,000 manufacturing workers, well below countries like South Korea, Japan, and Germany. That gap represents not a risk — but an opportunity.

Labor shortages, reshoring, and rising wage pressures are forcing companies to compete on productivity, not labor arbitrage. Robots help reduce waste, downtime, and defects — making factories faster, cheaper, and more resilient.

Automation is no longer about replacing workers; it’s about making entire systems more efficient.

You can see how quickly this adoption curve accelerates once companies commit. Amazon’s robot fleet has exploded from a small pilot program into nearly one million robots deployed globally, with growth accelerating sharply in recent years.

That kind of curve matters — because adoption in robotics is rarely linear. Once productivity gains are proven, companies scale fast.

But warehouses are just the beginning.

The robotics opportunity spans multiple massive segments:

• Professional service robots (logistics, warehousing, cleaning, healthcare) — estimated at $7.5 trillion

• Autonomous vehicles — roughly $6 trillion

• Humanoid robots — a potential $5 trillion market as general-purpose machines emerge

• Industrial robots embedded across manufacturing, energy, and infrastructure

The Founders Allocation Is Almost Full…

Last week, I opened a one-time Founders Allocation to a small group of subscribers.

With only a few spots remaining, this is your opportunity to secure a position to The Select Portfolio 2026 before it closes December 24th.

The Select Portfolio is not about trading headlines or chasing the hottest stock of the week.

It’s about positioning capital ahead of the biggest shifts I see unfolding over the next year — across biotech, AI’s second act, automation, electrification, copper, defense, infrastructure, mining, and more.

👉 Secure Your Select Portfolio 2026 Founders Allocation Spot Here

AI Is The Accelerant Tying All Of This Together.

Robots are no longer rigid machines performing repetitive tasks. With AI, they can see, learn, adapt, and work alongside humans.

Taiwan Semiconductor (TSM) has even discussed a future where over one billion AI-enabled robots could be deployed globally by 2030. That sounds aggressive — until you consider how many factories, warehouses, data centers, and logistics hubs exist worldwide.

For investors, this creates a rare setup.

We’re still in the early innings of a multi-decade transformation. The drivers behind automation — labor scarcity, reshoring, margin pressure, and AI — are structural, not cyclical. This isn’t a trade. It’s a shift.

That’s exactly why robotics and automation are a core theme inside my 2026 Select Portfolio.

Rather than chasing headlines or speculative concepts, I’ve focused on identifying companies positioned to benefit as automation adoption accelerates across industries — from manufacturing and logistics to semiconductors and infrastructure.

This is how major wealth is built: by getting positioned early, before trends become obvious and valuations reset higher.

I’ll continue breaking down these themes in Market Insights. But for investors who want direct exposure to the companies powering the robotics revolution, the 2026 Select Portfolio is where I’m putting these ideas to work.

Talk soon,

Matt McCall

Founder, NXT Wave Research