Yesterday was one of those days — the kind that separates the worried from the winners.

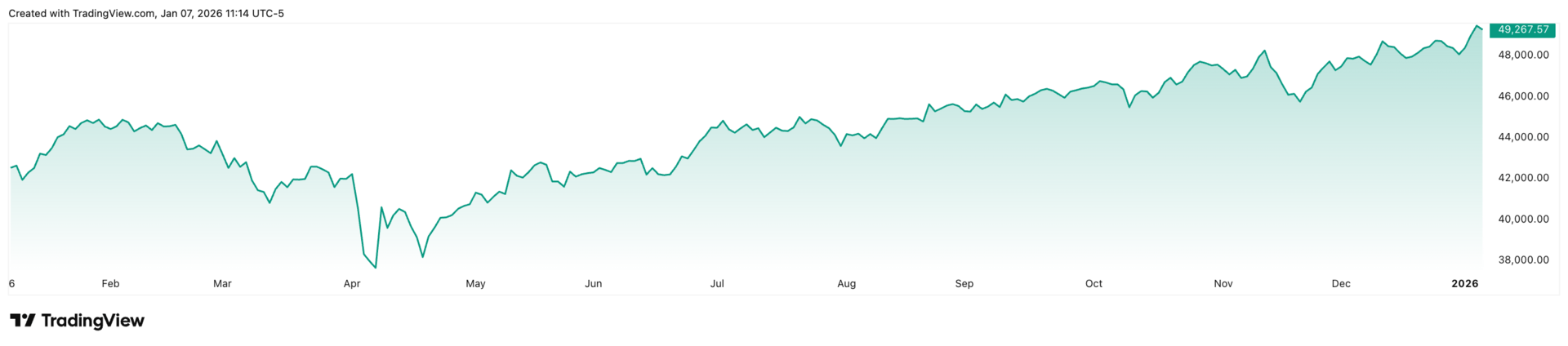

The Dow Jones Industrial Average blasted to a new all-time high, and for the first time ever it edged right up toward the 50,000 level.

Dow Jones Industrial Average

That’s right — the blue-chip benchmark that so many institutional pros and Main Street investors watch like a hawk is flirting with a number that was once the stuff of dreams.

Looking Beneath the Surface

But let’s be clear: while the Dow’s headline number is impressive and a great psychological marker… the real story is the breadth beneath the surface.

Because what we saw yesterday — and what’s been building for weeks — is that the entire market isn’t just being carried by a handful of mega-cap tech names anymore.

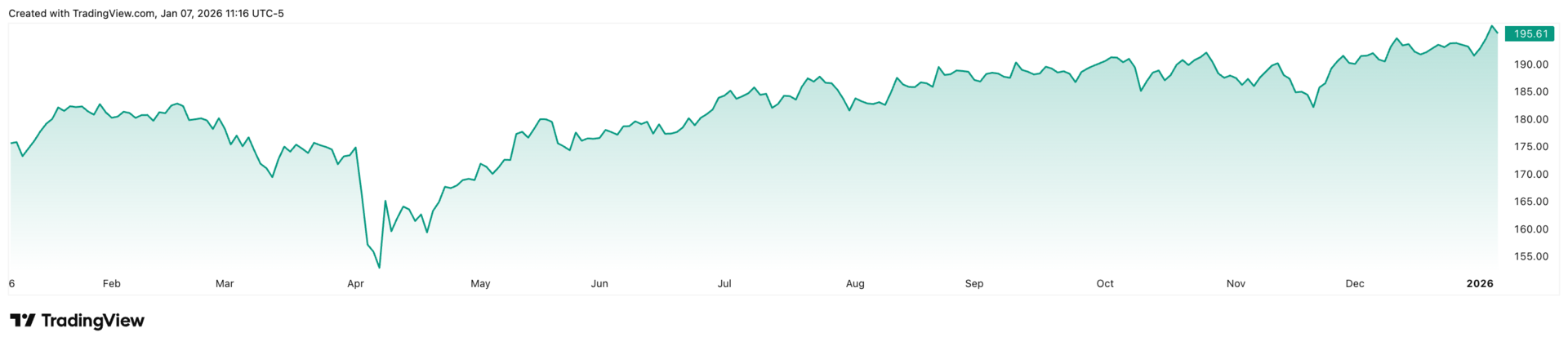

The Invesco S&P 500 Equal Weight ETF (RSP) just broke out to a new all-time high too.

And, that’s huge.

Invesco S&P 500 Equal Weight ETF

Why Breadth Matters

Why?

Because the RSP treats every company the same — whether it’s the biggest stock in the world or a mid-tier growth name. When only the largest megacaps are rising, the RSP lags. When the full market is participating, the RSP rises with it.

And right now… 493 stocks are showing strength, not just 5 or 10.

That tells us this rally is broad, real, and durable — not a narrow melt-up in a few headline names. It’s confirmation that the market’s risk appetite is healthy, earnings continue to support valuations, and capital is flowing into sectors outside the “usual suspects.”

And that’s exactly what you want to see at major long-term inflection points — like the Dow charging toward 50,000.

Stocks Hitting New Highs

Let’s put that into real stock names hitting new highs as part of this broader expansion:

TechnipFMC (FTI) — energy services demand remains robust and the Venezuela bump.

Nasdaq (NDAQ) — benefiting from record volumes and market participation.

CRH (CRH) — global infrastructure demand is real, and this building-materials powerhouse is surfacing near its best levels.

Eli Lilly (LLY) — leadership in biopharma and GLP-1 continues to reward patient holders.

Elbit Systems (ESLT) — defense tech and specifically drones staying in favor with resilient government spending.

Ondas Holdings (ONDS) —investors are betting on drone demand.

Guardant Health (GH) — health sciences growth showing resilience beyond the macro noise.

These aren’t random tickers.

They’re companies participating in the broader market advance, and their performance is confirmation that this isn’t a narrow breakout — it’s wide-ranging participation.

So while Wall Street gets hyped about the Dow approaching 50,000, insiders like us aren’t just watching round numbers — we’re watching broad market action and real stock leadership.

And right now? The market is signaling strength.

Talk soon,

Matt McCall

Founder, NXT Wave Research