Prediction markets — think Kalshi, Polymarket, and now even Robinhood (HOOD) — are no longer niche betting curiosities. They’re rapidly evolving into mainstream event-driven trading venues that blur the lines between gambling and traditional investing.

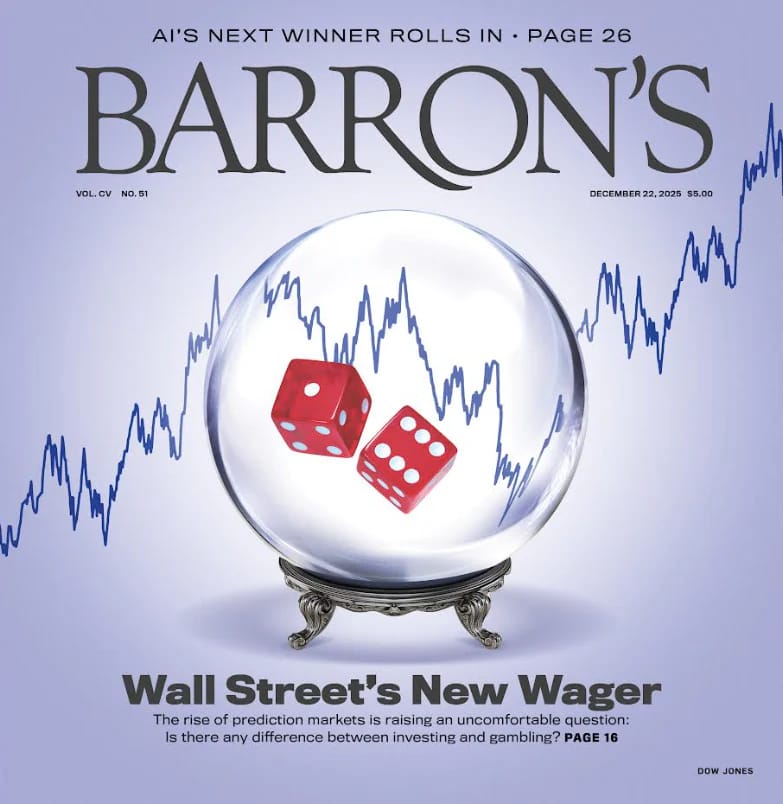

A few weeks ago, the cover of Barron’s was all about the rise of the prediction market. I wanted to share some highlights from the article and my view on the booming trend.

At the heart of the Barron’s piece: firms like Kalshi (a CFTC-regulated exchange) argue these markets aren’t “gambling” at all — they’re information aggregators that let participants trade contracts tied to future outcomes (sports results, elections, economic data, you name it).

The Big Takeaway For Investors

• Mainstream platforms are jumping in: Robinhood and other brokers are integrating prediction contracts into their offerings — a clear sign Wall Street sees engagement and revenue potential here.

• Regulation still lagging: Polymarket’s U.S. relaunch and Robinhood’s expansion show the gulf between rapid adoption and evolving regulatory frameworks — including ongoing debate over whether these products are “investing,” “gambling,” or something new entirely.

• Risk vs. reward matters: Binary outcomes mean you either profit big or lose the full position — the same dynamic that makes sports betting exciting can be dangerous for naive traders. Critics warn that without investor protections, these markets could create bubbles and behavior that looks more like casino speculation than disciplined capital allocation.

The Bottom Line

Prediction markets are fast morphing from fringe to mainstream. For serious investors, that means new data flows, hedging tools, and risk signals you won’t get from traditional markets — but also new forms of volatility and regulatory uncertainty.

From an investing view, there are two opportunities, in my opinion.

First, you can invest in the companies tied to the trend if you believe it has the ability to withstand potential regulations and grow its target market. Robinhood is the obvious choice, as they are already a player in the prediction markets.

Others To Watch

Interactive Brokers (IBKR)

DraftKings (DKNG)

Intercontinental Exchange (ICE)

The other opportunity is to become a user of the prediction platforms.

I am considering launching a beta-test newsletter that will share my thoughts on the current events that can be wagered on in the coming months.

Let me know if you are interested in being on the beta-test list.

Talk soon,

Matt McCall

Founder, NXT Wave Research