Copper, long known as “Dr. Copper” for its ability to reflect the health of the global economy, has surged to record prices in early 2026 as supply constraints tighten and demand accelerates.

This situation has been building for year due to the growth of the electrification of everything trend spanning AI, renewables, electric vehicles (EVs), and grid expansion.

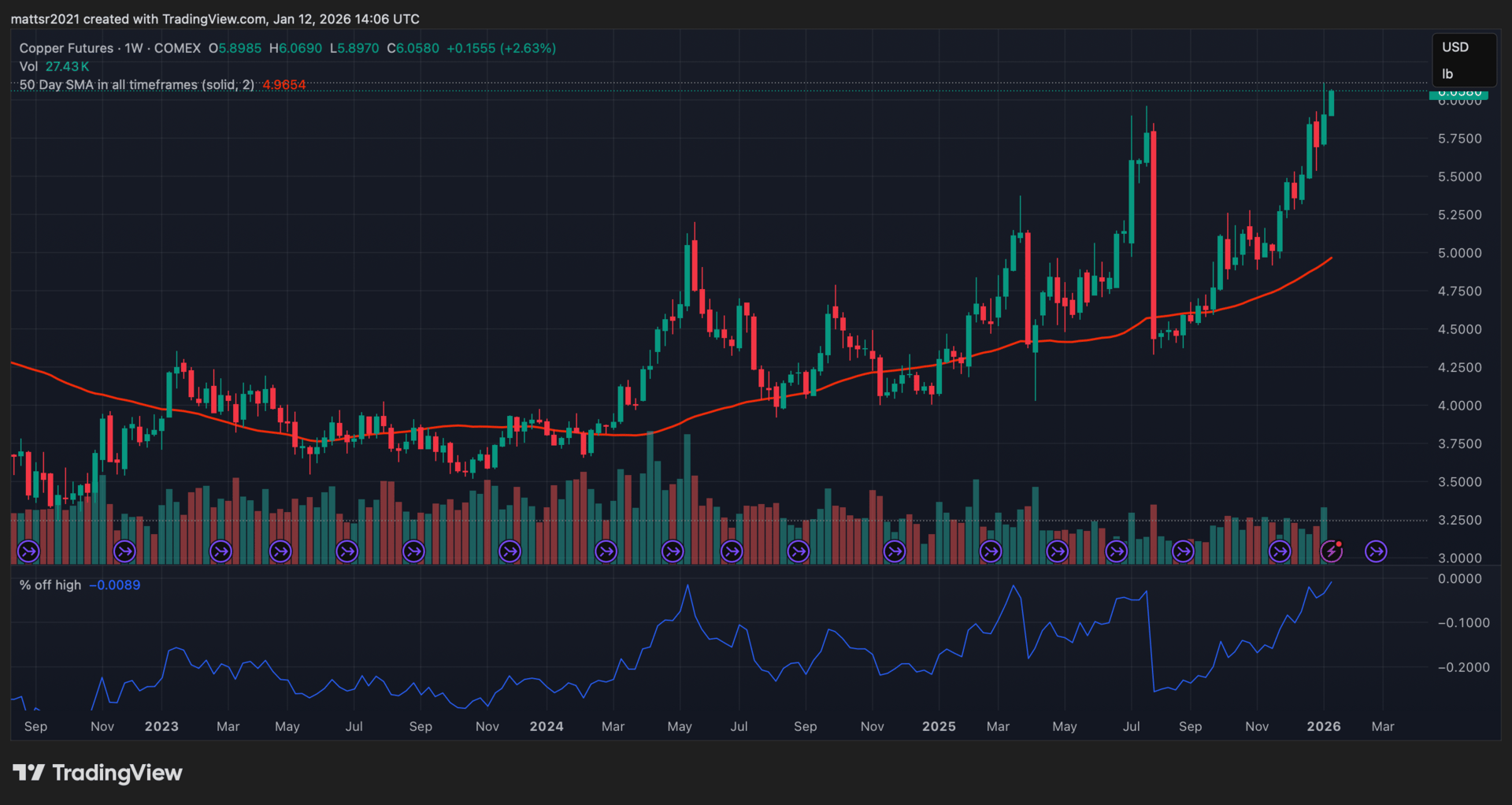

Copper recently climbed to above $6.00 per pound (~$13,000 per metric ton) — an all-time high on major exchanges.

This rally isn’t a short-term blip. Structural shifts in the global economy are creating persistent demand far outstripping supply — a dynamic that has serious implications for investors and policymakers alike.

Why the Supply Shortage Is Widening

A recent S&P Global study projects that global copper demand will jump 50% by 2040, rising from around 28 million metric tons today to roughly 42 million metric tons annually.

This surge is driven not just by traditional uses in construction and manufacturing, but by rapid electrification — including EVs, renewable power infrastructure, AI data centers, and even defense systems.

However, supply is failing to keep pace. The study warns that copper production could actually peak as early as 2030, leading to a projected 10 million metric ton shortfall by 2040 — roughly a quarter below projected demand.

Copper’s role as a critical mineral has been acknowledged by governments worldwide, including the U.S., reflecting its central importance to modern technology and infrastructure.

Yet new copper mines are extremely slow and capital-intensive to bring online (often 10–17 years from discovery to production), while existing mines face declining ore grades and higher costs.

Electrification Is the Demand Multiplier

From EV motors to charging stations, power grids to data centers, copper’s unmatched electrical conductivity makes it indispensable. For example:

A single EV contains three to four times more copper than a conventional car.

Renewable energy installations and grid upgrades require extensive copper cabling and components.

AI and data center infrastructure — projected to grow rapidly over the next decade — add a new layer of demand that is largely inelastic.

This convergence of demand positions copper alongside other industrial metals such as aluminum, nickel, and lithium, all of which are benefitting from the “electrification of everything” theme. As the global economy pivots toward clean energy and digital infrastructure, these metals are increasingly central to future growth.

Copper, Electrification & the Biggest 2026 Opportunities

Tomorrow at 4:00 PM ET, I’m hosting a free live event where I’ll go much deeper into what’s really driving copper’s historic breakout — and how investors can position themselves for the next phase of the electrification supercycle.

Everyone who joins the live event will receive a free copy of the NXT Wave Research 2026 Outlook — featuring over 60 stock ideas tied to the biggest trends shaping the year ahead.

No cost to attend — just click “Notify Me” after using the link below.

Investment Implications: Copper as a Top Opportunity

For investors, copper’s fundamental backdrop is rare: robust long-term demand growth combined with structural supply challenges.

While cyclical corrections can occur, the medium-to-long-term trend strongly favors higher prices. This makes copper — and selectively, related industrial metals — one of the most compelling investment opportunities of 2026.

Investors cannot ignore the industrial metals and only focus on gold and silver – all portfolios need to have some exposure to copper and the industrial metals powering the future. It is not easy for the average investor to buy into commodity futures and exchange-traded funds (ETFs) are often not the best option. That leaves copper mining equities as the best choice for investors looking to ride the copper bull market.

However, there are risks that come with attempting to invest in an individual mining company that might be too high for risk-averse investors.

The 2026 Market Map Event

That is why I am going live tomorrow at 4pm ET to discuss the best way to play copper and the other top trends of 2026. The key is deep research and knowledge of the trend – my team has spent hours researching – and diversification.

We’ll cover:

Why copper is becoming the new oil of the digital and AI economy

How the supply crunch could push prices even higher

The best ways to invest in copper, industrial metals, and electrification

Plus my top 2026 investment ideas across AI, energy, infrastructure, and defense

The breakout has already started…

With electrification trends only accelerating, and supply struggling to catch up, copper isn’t just a barometer of economic health — it’s at the heart of the next industrial supercycle.

Do not miss out on one of the most obvious investment opportunities for today and the next five years.

Talk soon,

Matt McCall

Founder, NXT Wave Research