Alright folks, if you were watching the tape today, you saw something big. I mean really big…

Nuclear-related stocks didn’t just tick higher. They ignited. And the catalyst? A power play from Meta Platforms (META) that’s starting to rewire how Wall Street thinks about energy and the future of AI.

Meta didn’t just talk about clean energy. They signed the deals. They inked long-term agreements with three major nuclear players, Vistra (VST), Oklo (OKLO), and Terrapower, to secure a whopping 6.6 gigawatts of nuclear power to fuel its sprawling AI data center empire over the coming decade and beyond.

That’s not a press release headline. That’s strategic infrastructure underwriting, and the market woke up to it today.

Let’s break this down for a second in plain English:

AI brains don’t run on hopes and solar panels. They run on a LOT of electricity, and it has to be reliable.

Solar and wind are great, but the sun doesn’t always shine and the wind doesn’t always blow.

Nuclear? That runs around the clock, 365 days a year, and Meta just locked it in.

And investors finally clicked the light switch.

Here is a look at the view during my run yesterday – it must have been a sign from above about the news that was about to hit the wires.

Oklo — The Rocket Ship

Oklo Inc.

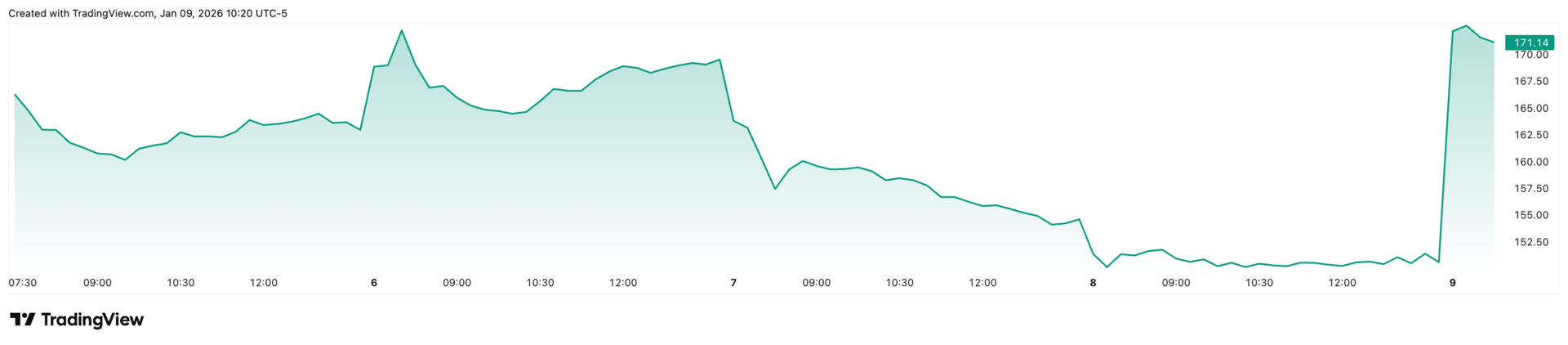

One of the biggest movers was Oklo. This company is building small modular nuclear reactors (SMR) — basically the next generation of nuclear power technology. Today’s news gave Oklo its first major commercial contract with Meta, which basically means Meta is putting real money behind Oklo’s future output.

And the tape reacted accordingly — Oklo’s stock surged 17% on the open as traders priced in big future growth. This isn’t speculation anymore — it’s contracted revenue and long-term demand. That’s exactly the kind of narrative that attracts real capital.

Vistra — The Steady Hand

Vistra Corp.

Meanwhile, Vistra — a more established utility with existing nuclear plants — got a healthy bounce too. Meta locked in multi-year power purchase deals with Vistra, and that’s exactly what Wall Street likes: predictable cash flows with growth upside. Investors reward that with higher multiples — and today Vistra got its share of enthusiasm – opening up 15%.

What This Really Means

This isn’t just a one-day pop. What we’re watching unfold is a narrative shift in how the market values nuclear power:

It’s not just about clean energy anymore — it’s about AI power security.

Tech giants are now outbidding utilities for long-term nuclear supply.

Nuclear stocks are being re-priced as infrastructure plays, not outdated relics.

And retail traders — don’t sleep on this. A narrative shift like this pulls money from other corners of the market and re-allocates it where growth is expected.

Look at it this way: if AI is the brains of the next technological wave, energy — especially reliable, scalable energy — is the fuel. And nuclear is right at the center of that.

So What Should You Watch?

Here’s how I’m thinking about this going forward:

Regulatory News Helps — A Lot

If the NRC starts moving faster on advanced nuclear licensing, that’s rocket fuel for these names.

Follow-on Deals Matter

If we start hearing about Microsoft, Google, or Amazon chasing similar long-term nuclear contracts, that’s a trend. And trends stick.

Watch the Sector Flow

Today’s leaders could be joined by others — think next-gen nuclear tech plays and utility companies with nuclear footprints.

Bottom Line

Today was one of those moments where a fundamental shift — energy meets AI demand — showed up in stock prices loud and clear. Nuclear power just went from an “old energy” afterthought to a core piece of the future infrastructure puzzle.

And if you’re a retail investor with vision and patience? Opportunities like this don’t come around every quarter.

Talk soon,

Matt McCall

Founder, NXT Wave Research